Objectives and tasks

A key lesson learned from the financial crisis

The financial crisis 2008/2009 has shown that, left by its own devices, microprudential supervision, which focuses on the safety and soundness of individual financial institutions, and a monetary policy aimed at maintaining price stability do not suffice to safeguard the stability of the financial system. The reasons are manifold and include:

- The higher interdependence of financial institutions has significantly increased the potential for contagion and the pace of contagion.

- The impact of the inherently procyclical behavior of banks on the stability of the financial system had been highly underrated.

- The negative incentives arising from a “too big to fail” approach, implicit government guarantees and the favorable tax treatment of debt capital affect all institutions.

Focusing on the safety and soundness of the financial system as a whole, the newly established framework of macroprudential supervision closes the gap between microprudential supervision and monetary policy.

Objectives

Macroprudential supervision is aimed at maintaining financial stability.

The objectives of the Financial Market Stability Board have been defined in Article 13 (1) of the Federal Act on the Institution and Organisation of the Financial Market Authority. Accordingly, these objectives are:

- promoting financial market stability;

- reducing the systemic threat; and

- lowering the systemic and procyclical risks.

To sketch a path toward achieving these ultimate goals, the European Systemic Risk Board (ESRB) has specified five intermediate objectives:

- preventing excessive growth and leverage;

- preventing excessive maturity mismatch and market illiquidity;

- preventing direct and indirect exposure concentrations;

- strengthening the resilience of infrastructures; and

- addressing misaligned incentives and reducing moral hazard.

To meet these ambitious objectives, supervisors have had at their disposal a range of instruments based either on national law or on EU legislation since January 1, 2014.

Tasks

The big challenge of macroprudential supervision is that supervisors must take preventive action. They base their decisions on systemic risks that need to be identified as they are building up, e.g. while the economy is undergoing a (possibly unsustainable) boom phase. These risks may arise, for instance, from unsustainable credit growth, increases in interdependence and unsustainable increases in asset prices (real estate, bonds, stocks, commodities).

The tasks of the Financial Market Stability Board have been defined in Article 13 (3) of the Federal Act on the Institution and Organisation of the Financial Market Authority:

- discussing facts relevant to financial market stability;

- encouraging cooperation and the exchange of opinions among the institutions represented on the Board in normal times and in times of crisis;

- issuing expert opinions, recommendations and requests in connection with the capital risk of institutions and a resulting systemic threat;

- issuing warnings about risks that may have an adverse impact on financial stability;

- issuing recommendations to the FMA with a view to averting risks to financial stability;

- discussing warnings and recommendations of the European Systemic Risk Board;

- presenting a report to parliament on an annual basis.

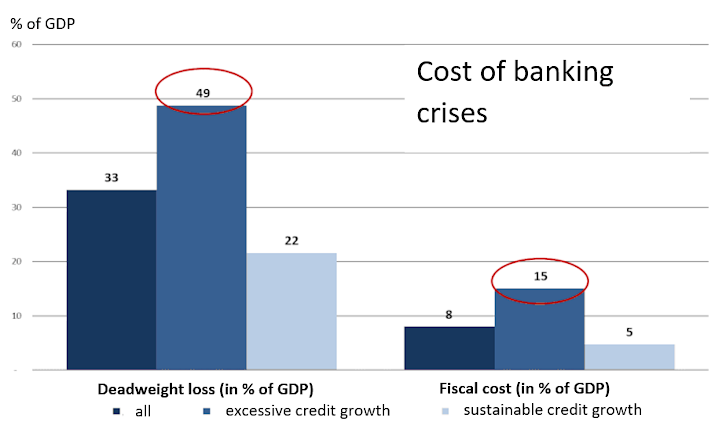

Cost and benefit of macroprudential supervision

Effective macroprudential supervision does increase costs in the short term in the form of cushioned economic growth, yet these costs should be outweighed in the long term by the benefit of a crisis prevented or mitigated. It is the task of macroprudential supervisors to prove the validity of this argument – a task representing a significant methodological challenge. The following chart illustrates the cost of past financial crises that could have been reduced through effective macroprudential supervision.

Source: IMF Global Banking Crises Data Base Update, OeNB calculations. Sample: EEA countries 1977-2008, n=34.

Macroprudential supervision is an innovation in supervision; to make it work in practice, it takes new macroprudential tools suitable for addressing systemic risks in a targeted and flexible manner. The set of new tools is aimed at remedying central deficiencies in the financial system. These tools can take the form of requirements for countercyclical capital buffers in the event of excessive credit growth, higher capital requirements for risks arising in individual sectors of the economy (for instance through an overheating of the real estate market), special liquidity requirements or additional disclosure requirements to increase market transparency. The challenge is to identify the need for more stringent macroprudential requirements in line with the principle of proportionality and efficiency with a view to adequately addressing the risks at hand through fitting measures.